Scaling Plans in Prop Trading: A Complete Guide to Account Growth

Scaling plans in proprietary trading are a game-changer for traders seeking to grow their funded accounts and maximize their earning potential. These plans are designed to reward consistent performance by increasing the capital allocation traders can manage over time. Proprietary trading firms, often referred to as prop firms, use scaling plans as an incentive for traders to maintain profitability while adhering to risk management rules.

In this guide, we will break down scaling plans in prop trading, their mechanics, benefits, and how traders can maximize scaling opportunities. Additionally, we will compare scaling plans across some of the top proprietary trading firms to help you choose the best option for your trading goals.

What are Scaling Plans in Prop Trading?

Scaling plans are structured programs offered by prop firms that allow traders to increase the size of their funded accounts based on specific performance milestones. These milestones often include:

- Achieving profit targets over a given period.

- Adhering to strict risk management guidelines.

- Maintaining consistent trading performance.

Scaling plans empower traders by providing access to larger trading capital, enabling them to execute more substantial trades and earn higher profits.

Scaling in prop trading isn’t just about growth — it’s about proving consistency, mastering risk, and unlocking limitless potential.

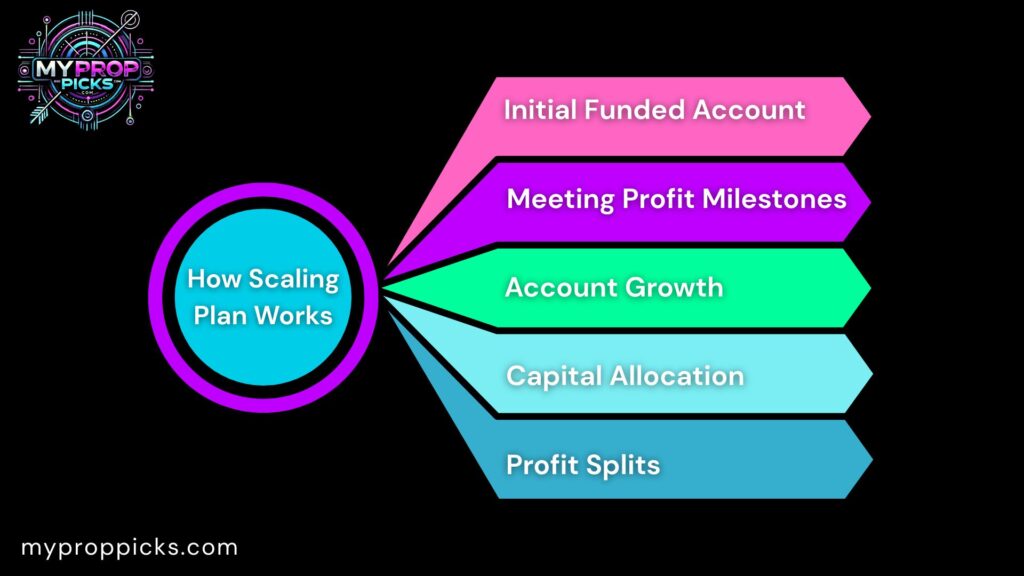

How Scaling Plans Work in Proprietary Trading

Scaling plans typically follow a milestone-based approach. Here’s a step-by-step explanation of how they operate:

Initial Funded Account: When traders join a prop firm, they start with an initial funded account. For example, a trader might begin with $10,000 to $50,000 in trading capital.

Meeting Profit Milestones: To qualify for scaling, traders must meet specific profit milestones within a set timeframe. For instance, achieving a 10% profit target over three months or maintaining a maximum drawdown of 5% or less during the trading period.

Account Growth: Once the trader meets the milestones, the prop firm increases their account size. For example, scaling plans might increase the account by 25% every quarter or double it annually for consistent traders.

Capital Allocation: As the account grows, so does the trader’s buying power. Firms allocate additional capital to traders, enabling them to take larger positions in the market.

Profit Splits: Profit splits typically remain unchanged during scaling. For example, traders may continue receiving 80%-90% of the profits, depending on the firm.

Advantages of Scaling Plans for Funded Traders

Scaling plans offer several benefits that make them an attractive feature for funded traders:

Larger Capital Allocation: Scaling plans allow traders to grow their accounts significantly, sometimes up to $1 million or more, depending on the firm. This provides opportunities to increase profits without risking personal funds.

Motivation for Consistency: The prospect of account growth incentivizes traders to focus on consistency, discipline, and adherence to risk management rules.

Risk-Free Capital Growth: Since the capital belongs to the prop firm, traders can scale their accounts without bearing personal financial risks.

Long-Term Trading Relationships: Firms offering robust scaling plans often foster long-term relationships with traders, creating opportunities for mentorship and career growth.

Increased Earning Potential: Larger account sizes translate to higher earning potential, as traders can place larger trades and achieve more significant profits.

Comparison of Scaling Plans in Top Prop Firms

Here’s a comparison of scaling plans offered by leading proprietary trading firms:

| Prop Firm | Initial Account Size | Scaling Plan | Profit Splits | Timeframe for Scaling |

|---|---|---|---|---|

| FTMO | $10,000 – $200,000 | +25% every 4 months for consistent traders | 80% – 90% | 4 months |

| The5%ers | $6,000 – $100,000 | Double the account size at milestones | 50% – 75% | Milestone-based |

| My Forex Funds | $10,000 – $300,000 | Gradual scaling with consistent performance | 85% | Monthly evaluations |

| E8 Funding | $25,000 – $400,000 | Scaling based on performance milestones | Up to 90% | Milestone-based |

| BluFX | $50,000 – $1,000,000 | Rapid scaling for consistent profitability | 50% – 75% | Biannual reviews |

How to Maximize Scaling Opportunities in Prop Trading

If you’re aiming to take full advantage of scaling plans, follow these strategies:

Stick to Risk Management Rules: Prop firms value traders who demonstrate strict adherence to risk management. Always stay within daily loss limits and maximum drawdowns.

Focus on Consistency: Scaling plans reward consistent performance over time. Avoid overtrading or taking unnecessary risks to achieve short-term gains.

Meet Profit Milestones Early: The sooner you achieve the profit target, the faster you qualify for account growth. Develop a trading plan focused on hitting these milestones.

Use Advanced Trading Tools: Leverage platforms like MT4, MT5, or cTrader for technical analysis and efficient trade execution. These tools can improve your accuracy and performance.

Leverage Educational Resources: Many prop firms offer webinars, strategy guides, and mentorship programs. Utilize these to refine your trading skills and increase your chances of scaling success.

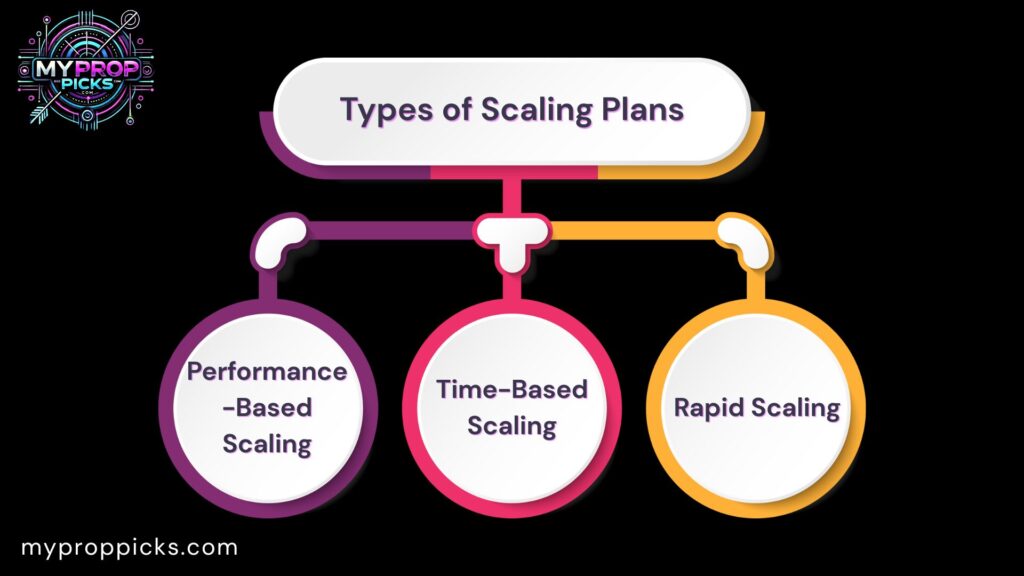

Types of Scaling Plans

Prop firms offer various types of scaling plans to accommodate different trader needs:

Performance-Based Scaling: This is the most common type, where account growth is directly tied to profit milestones. For example, achieve a 10% profit target every 3 months to qualify for a 25% account increase.

Time-Based Scaling: Some firms offer automatic scaling at fixed intervals, provided traders adhere to risk management rules. For instance, accounts grow by 10% every quarter regardless of profit milestones.

Rapid Scaling: Designed for high-performing traders, rapid scaling plans allow for quicker account growth. Examples include BluFX, which offers biannual reviews to double account sizes for consistent traders.

FAQs

1. What are scaling milestones in prop trading?

Scaling milestones are predefined profit targets or performance benchmarks that traders must meet to qualify for account growth.

2. Which prop firms offer the best scaling plans?

Top firms with robust scaling plans include FTMO, The5%ers, and My Forex Funds, each offering unique growth opportunities based on performance.

3. How can I scale my funded trading account?

To scale your account:

• Meet profit targets within the specified timeframe.

• Adhere to daily loss and maximum drawdown limits.

• Demonstrate consistent trading performance.

4. Are scaling plans risk-free?

Yes, scaling plans are risk-free for traders since the prop firm provides the capital. However, failure to meet rules or milestones may result in disqualification.

5. What is the maximum account size I can achieve?

Account sizes vary by firm, with some offering growth up to $1 million or more.

Conclusion

Scaling plans in prop trading are invaluable for traders seeking to grow their accounts and maximize earning potential. By meeting profit milestones and maintaining disciplined trading practices, traders can unlock significant capital growth opportunities. Whether you’re with FTMO, The5%ers, or My Forex Funds, understanding and leveraging scaling plans can be the key to long-term success.

Ready to grow your trading account? Explore our reviews of top proprietary trading firms and find the best scaling plan for your goals!