Types of Prop Trading Challenges: A Comprehensive Guide

Prop trading challenges are essential for traders aspiring to secure funded accounts with proprietary trading firms. These challenges assess a trader’s ability to meet profit targets, adhere to risk management rules, and consistently perform in diverse market conditions. However, not all challenges are created equal—prop firms offer various types of challenges to suit different trading styles and preferences.

This guide will break down the different types of proprietary trading challenges, how they work, and how traders can successfully navigate them.

Why Do Prop Trading Firms Use Challenges?

Prop trading challenges serve as evaluation tools for firms to identify skilled traders capable of handling firm capital. Instead of providing immediate funding, firms use these challenges to:

Test Trading Skills: Evaluate a trader’s strategy, risk management, and decision-making under pressure.

Mitigate Firm Risk: Ensure only proficient traders receive access to capital.

Encourage Discipline: Enforce strict trading rules to develop long-term trading success.

Every prop trading challenge is a test of skill, discipline, and strategy — choose wisely, trade boldly, and earn your funding.

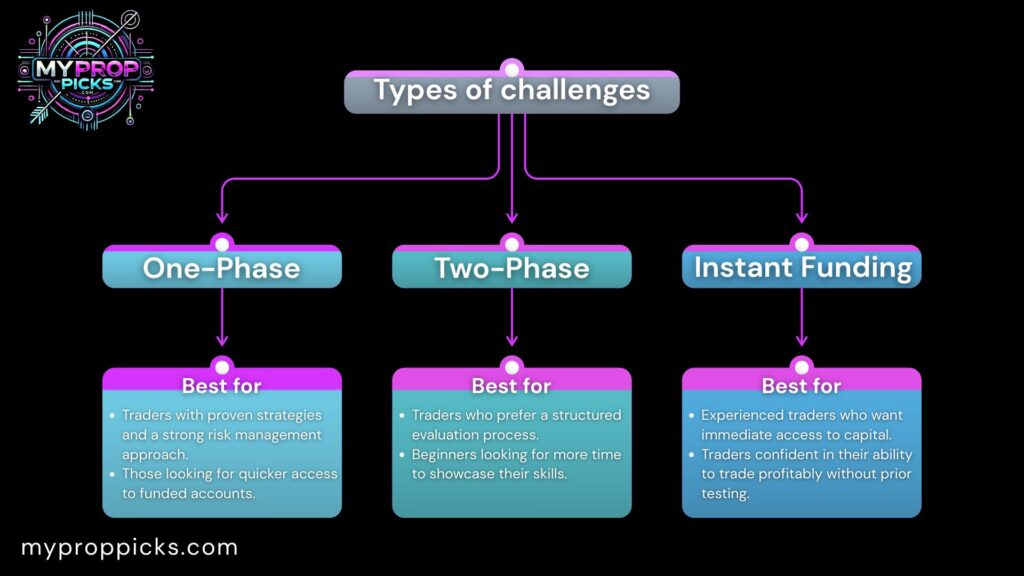

Types of Prop Trading Challenges

One-Phase Prop Trading Challenges

A one-phase challenge is a single-step evaluation designed for experienced traders who can achieve profit targets without extensive testing.

Features:

- One phase with a profit target of 8%-10%.

- Strict daily loss limits (e.g., 3%-5%).

- Shorter evaluation periods (e.g., 30 days).

- Immediate funding upon successful completion.

Who it’s best for:

- Traders with proven strategies and a strong risk management approach.

- Those looking for quicker access to funded accounts.

Two-Phase Prop Trading Challenges

A two-phase challenge is the most common evaluation model used by top proprietary trading firms.

Features:

- Phase 1: Profit target of 10% within 30-60 days.

- Phase 2: Reduced profit target of 5%-6% within 60 days.

- Adherence to risk rules, including daily and maximum loss limits.

Who it’s best for:

- Traders who prefer a structured evaluation process.

- Beginners looking for more time to showcase their skills.

Benefits:

- Tests consistency and adaptability over multiple phases.

- Provides traders with additional time to refine strategies.

Instant Funding Challenges

Unlike evaluation-based challenges, instant funding challenges, unlike evaluation-based challenges, skip the evaluation phase and provide immediate access to capital.

Features:

- No evaluation phase.

- Lower profit splits (e.g., 60%-75%).

- Higher initial costs compared to evaluation-based challenges.

Who It’s Best For:

- Experienced traders who want immediate access to capital.

- Traders confident in their ability to trade profitably without prior testing.

Drawbacks:

- Higher fees for entry.

- Stricter rules and profit-sharing limitations.

Scaling Plan-Based Challenges

Some proprietary trading firms incorporate scaling opportunities directly into their challenges, rewarding traders with higher account allocations as they meet performance milestones.

Features:

- Gradual increase in account size based on profit milestones.

- Traders can scale accounts up to $2 million or more.

Key Differences Between Challenges

| Feature | One-Phase Challenge | Two-Phase Challenge | Instant Funding |

|---|---|---|---|

| Profit Target | 8%-10% | Phase 1: 10%, Phase 2: 5%-6% | N/A |

| Evaluation Steps | 1 | 2 | None |

| Risk Limits | Strict | Moderate | Strict |

| Initial Funding | Fast | Moderate | Instant |

| Profit Splits | 80%-90% | 80%-95% | 60%-75% |

Key Challenges Faced by Traders

Risk Management in Challenges: Traders must adhere to strict risk rules, including daily loss limits, maximum drawdowns, and position sizing requirements. Failing to comply with these rules can lead to disqualification.

Meeting Profit Targets: Achieving profit targets within the time limits is often challenging, especially in volatile market conditions. For instance:

- One-phase challenges demand quick results.

- Two-phase challenges require consistency over longer periods.

Psychological Pressure: Prop trading challenges require discipline and focus. High-pressure environments can lead to emotional decision-making, which often results in errors.

Instant Funding vs. Evaluation-Based Challenges

One of the most common debates in proprietary trading is whether to pursue instant funding or evaluation-based challenges. Here’s a quick comparison:

| Aspect | Instant Funding | Evaluation-Based Challenges |

|---|---|---|

| Time to Funding | Immediate | 30-90 Days |

| Profit Splits | Lower (60%-75%) | Higher (80%-95%) |

| Initial Cost | High | Moderate |

| Risk Rules | Strict | Balanced |

Traders confident in their skills may opt for instant funding, while those seeking structured evaluations may prefer two-phase challenges.

How to Pass Prop Trading Challenges

Successfully passing a prop trading challenge requires a blend of skill, discipline, and preparation. Below are enhanced strategies to improve your chances of success:

Master the Rules of the Challenge: Every proprietary trading firm has its own set of rules, including profit targets, daily loss limits, and maximum drawdowns. Understanding these is non-negotiable.

- Key Tip: Make a checklist of the firm’s rules before starting the challenge to ensure compliance at every step.

Develop a Detailed Trading Plan: A strong trading plan acts as a roadmap for decision-making and reduces the risk of emotional trading. Include these components in your plan:

- Entry/Exit Points: Define when to enter and exit trades.

- Risk Management: Limit losses to a fixed percentage of the account per trade (e.g., 1%-2%).

- Trade Frequency: Stick to a specific number of trades per day or week.

- Key Tip: Backtest your plan with historical market data to assess its performance under different conditions.

Prioritize Risk Management: Risk management is critical in prop trading challenges. Even if you achieve the profit target, violating risk limits will disqualify you.

- Use position sizing to ensure no trade exceeds your risk tolerance.

- Set stop-loss orders for every trade to cap potential losses.

- Golden Rule: Never risk more than 2% of your account on a single trade.

Maintain Emotional Discipline: Prop trading challenges are designed to test not just your skills but also your discipline. Emotional reactions, such as revenge trading after a loss, can derail progress.

- Key Tip: Develop a pre-trading routine that includes mindfulness exercises or journaling to stay focused.

Use Simulated Accounts for Practice: Before attempting a real challenge, practice trading on a demo or simulated account. This will help you refine your strategies in a risk-free environment.

- Simulate the challenge rules as closely as possible (e.g., daily loss limits, profit targets).

- Analyze your performance metrics to identify areas for improvement.

Start Small and Scale Gradually: Begin with smaller account sizes to minimize pressure and risk. Once you gain confidence, move to larger accounts or challenges with higher funding potential.

Leverage Educational Resources: Many proprietary trading firms provide resources such as webinars, trading guides, and mentorship programs. Take advantage of these to enhance your skills.

- Key Tip: Follow prop trading forums or social media communities to learn from other traders’ experiences.

Focus on Consistency Over Aggression: Prop firms value consistent traders who can manage risk effectively over those who make big profits but take unnecessary risks.

- Avoid overtrading or using excessive leverage to meet profit targets quickly.

- Instead, aim for steady growth over the duration of the challenge.

FAQ

How do prop trading challenges work?

Prop trading challenges are designed to assess a trader’s ability to achieve profit targets within set rules. This includes adhering to daily loss limits, overall drawdowns, and trading timeframes.

What happens if I fail a challenge?

Failing a challenge typically means:

• Loss of entry fee (unless retry options are offered).

• You can reattempt the challenge by purchasing it again or taking advantage of discount offers.

Can I use automated trading systems for challenges?

Some firms, like My Forex Funds, allow the use of Expert Advisors (EAs) or trading bots, while others have stricter rules. Always check the firm’s terms and conditions.

How long do prop trading challenges last?

The duration depends on the type of challenge:

• One-phase challenges: Typically 30 days.

• Two-phase challenges: Phase 1 (30 days), Phase 2 (60 days).

• Instant funding: No duration; traders can start trading immediately.

What is the best strategy to pass a two-phase challenge?

The best strategy includes:

• Focus on hitting the profit target in Phase 1 without exceeding risk limits.

• Trade more conservatively in Phase 2 since the profit target is lower.

How do instant funding challenges work?

Instant funding challenges skip the evaluation process, allowing traders to trade with firm capital immediately. However, these often come with stricter profit splits and rules.

Conclusion

Prop trading challenges are gateways to accessing significant trading capital, but they require skill, discipline, and preparation to pass. By mastering the rules, developing a clear trading plan, and focusing on consistency, traders can increase their chances of success. With the right mindset and approach, you can excel in challenges offered by leading firms like FTMO, My Forex Funds, and others.

Ready to start your prop trading journey? Explore our detailed reviews of top proprietary trading firms like FTMO, The5%ers, and E8 Funding to find the perfect challenge for your trading goals!