How Prop Trading Works: A Complete Guide

Proprietary trading, or prop trading, is a financial strategy where firms trade their own money in the markets to generate direct profits. Unlike client-based trading, which earns revenue through commissions, prop trading focuses on self-driven market participation using sophisticated strategies and tools.

But what makes prop trading unique? And how does it actually work? This guide delves into the mechanics of proprietary trading, providing a step-by-step explanation of how prop trading operates, the strategies employed, and the process of becoming a successful prop trader.

Prop trading model empowers you with capital, structure, and the freedom to trade your edge — success is in your hands.

How Prop Trading Works

The proprietary trading process is a systematic approach involving capital allocation, advanced strategies, and risk management. Let’s break it down into essential components.

- Capital Allocation: Prop firms allocate capital to traders based on their skill levels, track records, or after an evaluation process. Typically, new traders start with smaller account sizes and increase their capital allocation through scaling plans as they demonstrate consistency and profitability. For example:

- New traders may start with $5,000–$10,000.

- Experienced traders can handle accounts ranging from $50,000 to $200,000 or more.

This approach allows traders to focus on executing strategies without risking personal funds.

- Trading Strategies: Prop trading firms employ diverse strategies tailored to various market conditions. Some of the most common include:

- Spread Trading: Exploiting price differences between related instruments, such as futures contracts.

- Momentum Trading: Capturing trends in fast-moving markets by buying when prices rise and selling during declines.

- News-Based Trading: Leveraging market movements triggered by major economic events or announcements.

- Reversion to Mean: Identifying overbought or oversold instruments and anticipating price corrections.

- Market Making: Providing liquidity by quoting buy and sell prices, earning profits from the bid-ask spread.

- Arbitrage: Identifying and exploiting price discrepancies between instruments or markets.

- Algorithmic Trading: Leveraging high-frequency trading (HFT) algorithms for rapid execution.

Each strategy requires careful planning and adherence to risk management protocols.

- Risk Management Rules: Effective risk management is the cornerstone of prop trading. Firms enforce the following:

- Daily Loss Limits: Prevent significant drawdowns within a single day.

- Maximum Drawdown: Caps the total allowable loss for an account.

- Position Sizing: Ensures trades are appropriately sized relative to account balances.

- Stop Losses: Automatically limits losses on individual trades.

- Evaluation Process: For new traders, prop firms typically require passing an evaluation process before allocating significant capital. This process often involves:

- Phase 1: Meeting a profit target, such as 8%-10%, within predefined rules.

- Phase 2: A second phase to confirm consistency, often with smaller profit targets like 5%-6%.

- Scaling Plans: Scaling plans allow traders to grow their capital as they prove their ability to manage risk and generate consistent profits. For example:

- FTMO Scaling Plan: Traders can increase their account size by 25% every 4 months if they achieve specific profit targets.

- Prop Trading Express: Some firms offer instant funding with scaling opportunities based on performance metrics.

- Profit Splitting: One of the most appealing aspects of prop trading is the profit-sharing model. Depending on the firm and the trader’s performance, profit splits often range from 80%-95%, with the firm retaining the rest as an operational fee.

Unique Challenges in Prop Trading

Dynamic Market Conditions: Markets are constantly evolving, driven by global events, economic data, and geopolitical factors. Traders must adapt quickly to changing trends to remain profitable.

Trader Independence: Unlike retail trading, where individuals rely on personal funds, prop traders must navigate the expectations of their firms, adhering to predefined rules while delivering consistent performance.

High-Performance Benchmarks: Prop traders are expected to meet stringent benchmarks for profit targets, risk control, and adherence to rules. Failing to meet these benchmarks may result in losing access to firm capital.

Solutions to Overcome Challenges

Education: Leverage resources like webinars, strategy guides, and mentorship programs to build expertise.

Risk Mitigation: Stick to pre-defined trading plans and stop-loss orders.

Psychological Preparation: Develop emotional discipline through mindfulness and practice.

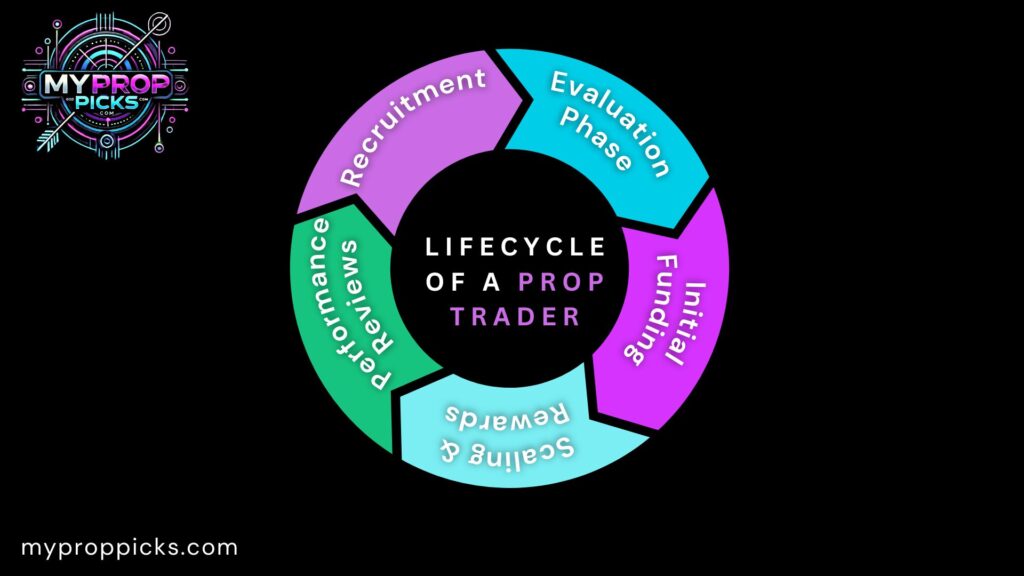

The Lifecycle of a Prop Trader

To truly understand how prop trading works, it’s important to look at the lifecycle of a trader within a prop trading firm:

- Recruitment: Aspiring traders apply to prop trading firms and undergo an evaluation phase to assess their trading skills, risk management, and discipline.

- Evaluation Phase: Traders trade in a simulated or live environment with limited capital. Success in meeting profit and risk targets leads to funded accounts.

- Initial Funding: Upon passing the evaluation, traders receive their first allocation of capital, typically ranging from $5,000 to $200,000, depending on the firm.

- Scaling and Rewards: Consistently profitable traders can qualify for scaling plans and profit-sharing bonuses, increasing both their capital and earning potential.

- Performance Reviews: Periodic performance reviews assess a trader’s adherence to rules and their ability to adapt to market changes.

Why Prop Trading Works for Traders

Prop trading is particularly appealing for traders who lack access to significant personal capital. By partnering with proprietary trading firms, traders gain:

- Access to Large Capital: Firms provide the funds, allowing traders to focus on strategy execution.

- Reduced Financial Risk: Traders don’t risk their personal funds, as losses are absorbed by the firm.

- Advanced Tools: Access to cutting-edge platforms like MT4, MT5, and cTrader enhances trading capabilities.

For traders willing to embrace the challenges, prop trading offers a unique pathway to financial success.

Conclusion

Proprietary trading is an intricate process that combines strategic thinking, discipline, and cutting-edge tools to generate profits. From capital allocation and strategy development to scaling plans and profit-sharing models, prop trading offers traders an unparalleled opportunity to succeed in the financial markets.

Whether you’re an aspiring trader or a professional seeking to scale your trading, understanding how prop trading works is the first step toward achieving your goals.

Interested in finding the right proprietary trading firm? Explore our reviews of FTMO, The5%ers, and more to kickstart your journey today!